17.09.2024

In this article, we provide answers to basic questions about private equity funds, along with a glossary. The article is aimed at those exploring the operations of private equity funds for the first time and at those interested in Taaleri’s shares.

The primary focus of private equity funds is to create value for investors, and their operations are generally quite straightforward. However, the industry-specific terminology, such as feeder fund, hard cap, closing and closed-end fund, can make the operations seem more complex than they are.

In this article, we provide answers to basic questions about private equity funds, along with a glossary. The article is aimed at those exploring the operations of private equity funds for the first time and at those interested in Taaleri’s shares.

What is a private equity fund?

Private equity (PE) funds primarily invest in assets on behalf of institutional investors, according to a predetermined, fund-specific investment strategies, managed by investment teams that are referred to as general partners (GPs). However, PE funds have also gained popularity among other investors and continue to attract new ones. These funds are typically structured as limited partnerships, where investors are referred to as limited partners (LPs).

Private equity funds typically invest in illiquid assets such as unlisted companies, infrastructure projects and real estate. The fund gradually calls capital from the investors based on the investment commitments they have made, when suitable opportunities aligned with the fund's strategy are identified and an investment decision is made. Sometimes private equity fund can acquire all or most shares of public company and de-list it.

Experience has taught us at Taaleri that sustainability and profitability thrive side by side. Our private equity funds create, for example, wind and solar power, bio-based products that replace fossil resources and affordable and energy-efficient rental homes.

Why invest in a private equity fund?

Private equity is an attractive asset class for several reasons:

- Historically, private equity investments have outperformed other asset classes.

- Private equity investments typically have low correlation with other asset classes, and the volatility of private equity funds is usually lower than that of the listed market.

- Including private equity investments in a portfolio provides diversification benefits for investors.

What does a private equity firm do?

A private equity firm manages private equity funds and represents the general partner (GP), who makes decisions regarding the fund. The firm's responsibilities include sourcing investment opportunities, buying and selling assets, portfolio management, risk management, asset management, capital calls, distributions, investor reporting, and accounting.

What is the typical size of a private equity fund?

The size of private equity funds vary a lot, ranging from tens of millions to billion-dollar mega-funds. The size of a fund depends on factors such as the asset class it invests in, the experience and capability of the team, and other strategy-related aspects such as the characteristics of investment targets, market size, return expectations and geographical constraints. Typically, funds aim to increase in size from one vintage (defined by the year the fund was established) to the next, following successful execution of the fund's strategy and meeting or exceeding investors' return expectations.

The individual ticket sizes of different investors, also known as investment commitments, vary too.

What are the differences between closed-end and open-end funds?

A closed-end fund is established for a specific period, meaning limited partners (LPs) commit their capital for the fund's entire lifecycle and they cannot withdraw their funds. Closed-end funds also have a limited time period for subscriptions. The cashflow profiles of closed-end funds differ a lot depending on the type of assets it invests in and whether they are cash yielding or not. In some cases, capital is only returned to the LPs after successful asset sales, also known as exits.

In open-end funds, investors typically have the opportunity to subscribe or withdraw capital 2–4 times per year. Practices vary among funds.

Private equity funds are classified as alternative investment funds. Closed-end funds typically invest in asset classes that are otherwise difficult for investors to access due to factors such as illiquidity of assets, corporate structure, geographical location or other considerations. Examples of such investments are large renewable energy projects, unlisted bioindustry companies, or extensive real estate portfolios. The fund structure allows for diversifying risks associated with such large single investments.

What is the life cycle of a closed-end fund?

Investing in private equity involves a long-term commitment. The life cycle of closed-end funds typically ranges between 7 and 12 years. A fund is established once it has collected sufficient investment commitments, which are then invested according to the fund's strategy. Closed-end funds are typically raised as blind pools, meaning specific investment targets may not be identified at the fund's inception. Commitments are called in as suitable opportunities arise and after the investment decision has been made. The active investment period of a fund typically lasts around five years from its establishment.

Following investments, the fund enhances the value of its assets and proceeds to sell them during the exit phase.

The fund's lifecycle is impacted by the market environment. Exits may occur sooner than initially anticipated if the market is exceptionally favourable.

Who are the clients?

The clients of a private equity firm typically consist of institutional investors such as pension funds and foundations. Other professional investors such as family offices are also relevant. Due to the inherently illiquid nature of private equity funds and the uneven timing of capital calls and distributions, they may not be suitable for some individual retail investors.

Where do the LPs' returns in private equity funds come from?

Returns for LPs vary across different asset classes and investment strategies. In some strategies, the emphasis is on stable cash flow (e.g., core/core+ real estate funds based on rental income), while others aim for higher returns during the fund's exit phase. Refinancing can provide investors with a one-time larger return during the fund's lifecycle.

How is the business profitable for the asset manager?

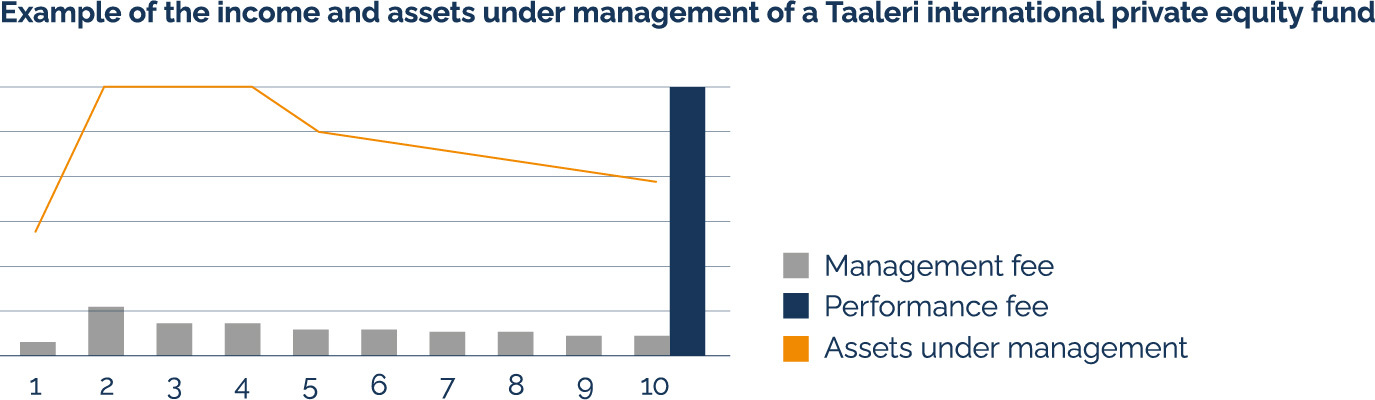

Different funds have slightly different earning models, which consist of management fees and performance fees or carried interest. Typically, the fund’s performance fee is realised in full or to a large extent in connection with the fund exit (see figure below).

The management fee is usually earned for the first years based on the amount of the fund’s investment commitments and, after the investment period, on the invested amount. Exits carried out after the fund’s investment period reduce the assets under management. When a fund exceeds its targets, it may distribute performance fee in accordance with the fund’s rules. Typically, Taaleri assesses performance fees and their realisation every six months, at which time performance fees are recognised as income if the specified conditions have been met. The final amount of the performance fee will be determined in connection with the exit of the fund, at which point the performance fee will be paid.

Terminology

Assets under management refers to the total amount of assets managed by an asset manager. The methods for calculating AUM can vary between companies.

The investment commitment is paid in smaller instalments, typically over several years, as the fund makes new investments. A call is typically expressed as a percentage of commitment.

A closed-end fund is established for a pre-agreed period. LPs commit to the fund for its entire lifecycle. Closed-end funds are open for new commitments for a limited time.

Fundraising consists of fundraising rounds that terminate in closings. A closing is an interim stage in fundraising when investors are admitted as LPs in the fund. Typically, there are several closings during the fundraising period. A fund’s first closing typically coincides with the formation of the fund.

A fund that is an LP in another fund. The feeder channels money to the main fund.

A fund that invests in other funds rather than in individual companies or projects.

An agreement that guides the management of the fund and sets limits on fund investment activity.

An investment team gathers investment commitments for a new fund. The fundraising period can extend over a couple of years.

The GP makes all decisions regarding the fund. The decisions are guided by the fund agreement.

Maximum amount of investment commitments that a fund can have. Hard caps vary between funds.

A hurdle rate is a performance threshold that ensures LPs get a certain return on their investment before the general partners (GP) receive any incentive fees. When a fund’s return exceeds this threshold, it may distribute a performance fee or carried interest in accordance with the fund’s rules.

Total amount that a single investor has committed to invest in the fund.

A direct investor in a fund. An LP cannot make decisions for the fund.

A fee paid to the fund manager for managing the fund.

The management fee is usually earned for the first years based on the amount of the fund’s investment commitments and, after the investment period, on the invested amount. Exits carried out after the fund’s investment period reduce the assets under management.

A fund that is typically open 2–4 times a year for new investors and capital redemptions.

Investing in illiquid assets that do not have a market value as listed stocks do, for example. Investments are often made in private companies or infrastructure.

Where a fund exceeds its return targets, it may distribute the incentive fee to the fund manager in accordance with the fund’s rules. The performance fee or carried interest is typically linked to the hurdle rate.

Type of distribution to investors.

A target size for all investment commitments of the fund.